OLD SECOND BANCORP, INC.

37 South River Street, Aurora, Illinois 60507

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 15, 2018

AUGUST 18, 2020

TO THEOUR STOCKHOLDERS:

The annual meeting of stockholders of Old Second Bancorp, Inc., will be held on Tuesday, May 15, 2018,August 18, 2020, at 9:00 a.m., central time,time. As noted below, due to health and safety concerns related to the coronavirus (COVID-19), this year’s annual meeting will be a completely virtual meeting of stockholders. You can attend the meeting via the Internet at North Island Center, 8 East Galena Blvd., 60506, Aurora, Illinois,www.virtualshareholdermeeting.com/OSBC2020 by using the 16-digit control number which appears on your proxy card and the instructions included in these proxy materials. The meeting will be held for the following purposes:

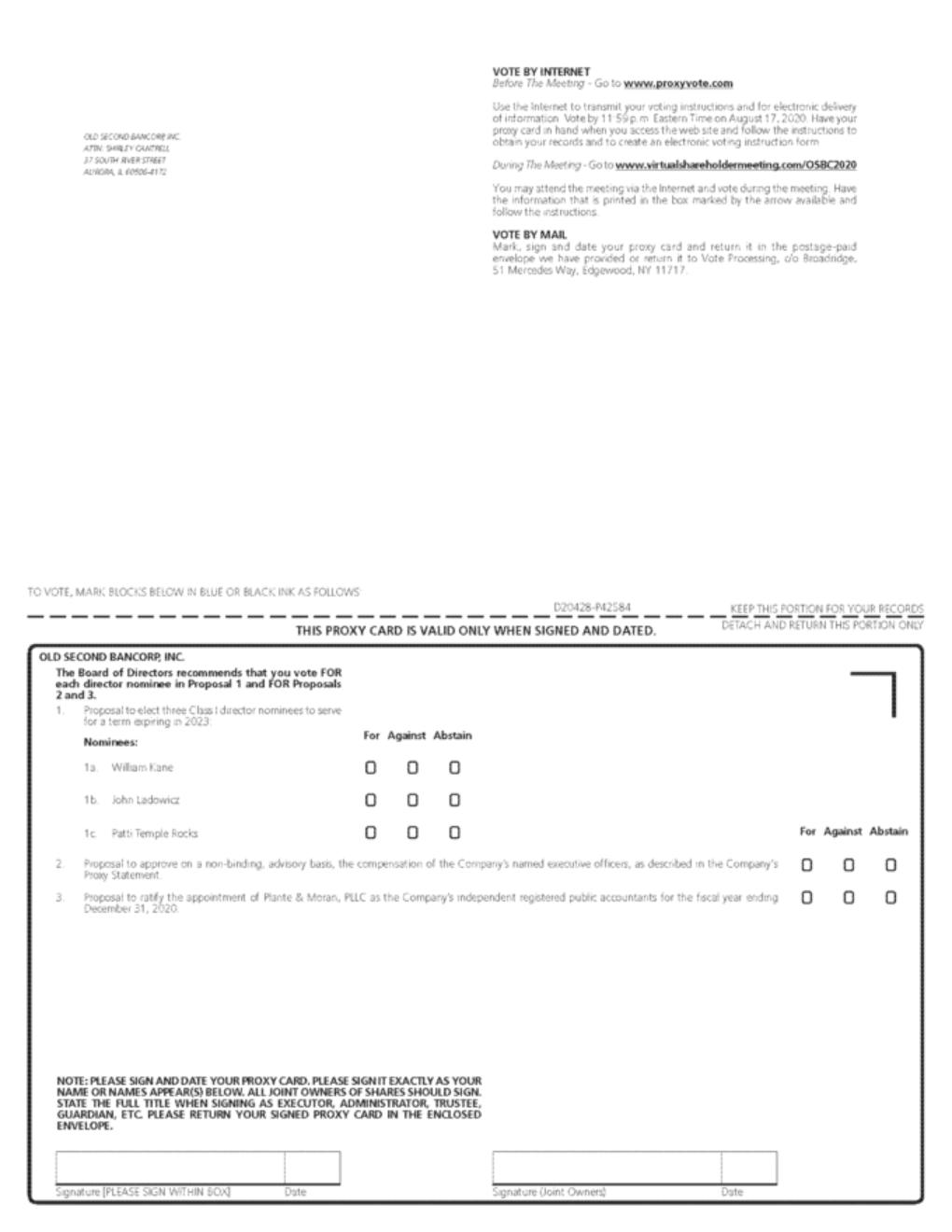

1.to elect the four director nominees named in the accompanying proxy statement;2.to approve, in a non-binding, advisory vote, the compensation of our named executive officers;3.to ratify the appointment of Plante & Moran, PLLC as our independent registered public accounting firm for the year ending December 31, 2018; and4.to transact such other business as may properly be brought before the meeting or any postponements or adjournments of the meeting.

| 1. | to elect the three Class I director nominees named in the accompanying proxy statement; |

| 2. | to conduct an advisory, non-binding vote to approve the compensation of our named executive officers; |

| 3. | to ratify the appointment of Plante & Moran, PLLC as our independent registered public accounting firm for the year ending December 31, 2020; and |

| 4. | to transact such other business as may properly be brought before the meeting or any postponements or adjournments of the meeting. |

The board of directors is not aware of any other business to come before the meeting. Stockholders of record at the close of business on March 30, 2018June 26, 2020 are the stockholders entitled to vote at the meeting and any and all adjournments or postponements of the meeting. In

Our board of directors and management is sensitive to the event thereevolving developments associated with COVID-19, including current Illinois government health directives to use social distancing and to limit the size of gatherings. The health and well-being of our employees, stockholders, directors, officers and other stakeholders are an insufficient number of votes for a quorumparamount. Your virtual attendance at the timemeeting affords you the same rights and opportunities to participate as you would have at an in-person annual meeting. We intend to resume in-person meetings of our stockholders under normal circumstances.

Whether or not you plan to virtually attend the annual meeting, we urge you to vote now to make sure there will be a quorum for the meeting. Voting by the Internet is fast and convenient, and your vote is immediately confirmed and tabulated. You may also vote by completing, signing, dating and returning the accompanying proxy card in the enclosed return envelope furnished for that purpose. If you attend the meeting virtually over the Internet, you may be adjournedcontinue to have your shares of common stock voted as instructed in a previously delivered proxy or postponed in order to permit further solicitationyou may vote your shares of proxies.common stock via the Internet during the meeting.

Important Notice Regarding Availability of Proxy Materials for the Annual Meeting: Our 20182020 proxy statement, proxy card and 20172019 Annual Report to ShareholdersStockholders are available free of charge online at www.oldsecond.com under "2018“2020 Annual Meeting Materials."”

| | |

| By order of the board of directors | |

|

| |

| James L. Eccher |

Aurora, IllinoisApril 13, 2018

IMPORTANT: THE PROMPT RETURN OF PROXIES WILL SAVE US THE EXPENSE OF FURTHER REQUESTS FOR PROXIES TO ENSURE A QUORUM AT THE MEETING. A SELF-ADDRESSED ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE. NO POSTAGE IS REQUIRED IF MAILED WITHIN THE UNITED STATES.

July 17, 2020